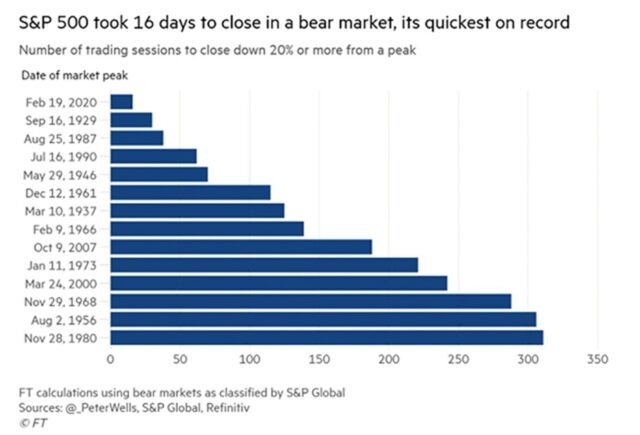

The first quarter of 2020 has been an unprecedented period in US financial history. An exogenous shock from a novel coronavirus- COVID-19 led to the fastest 20% decline in US stock market history, falling into bear market territory just within 16 trading days, and another 10% decline in the next 8 days. The sell-off driven by the uncertain human impact of the virus forced public officials around the world to implement aggressive disease prevention policies to help stop the spread that essentially brought all economic activity to a grinding halt. With anticipation that the global economy was on the brink of an impending recession, nervous sentiment started flowing through global stock markets, and started discounting possible severe outcomes. Short term volatility expectations measured by the VIX index- often referred to the “fear index”, spiked to an all time high on March 16th.

Policy Response

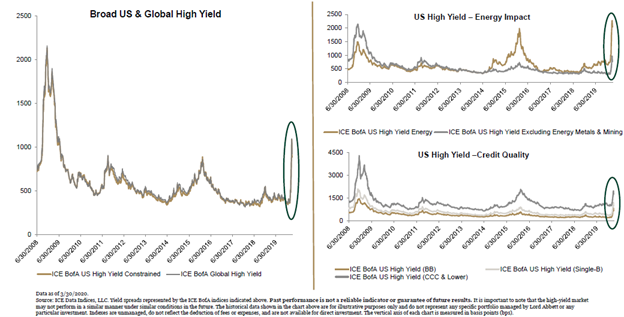

Policy makers seem to have learned from their previous financial crisis mistakes when policy response came too slowly and passively. Using history as a barometer, time is of the essence and policy response usually have to be big and fast to help thwart a crisis from escalating further. On March 15th, the Federal Reserve held an emergency meeting that resulted in cutting interest rates to near zero, the lowest since the creation of the Fed. The 10-year and 30-year Treasury yields also achieved a record in Q12020 when yields fell to an all-time low at 0.54% and 0.99% respectively. The Fed took it to another level when it restarted its quantitative easing program (QE), engaged across bond markets to ensure liquidity is flowing, and acted as the lender of last resort by providing loans to households and small businesses. Fiscal policy makers were also swift to respond, with Congress passing an unprecedented $2 trillion stimulus package on March 27th to support individuals and businesses until the storm has passed. Discussions continue about additional steps to take to support the market and economy.

Liberty One Strategies

Policy makers seem to have learned from their previous financial crisis mistakes when policy response came too slowly and passively. Using history as a barometer, time is of the essence and policy response usually have to be big and fast to help thwart a crisis from escalating further. On March 15th, the Federal Reserve held an emergency meeting that resulted in cutting interest rates to near zero, the lowest since the creation of the Fed. The 10-year and 30-year Treasury yields also achieved a record in Q12020 when yields fell to an all-time low at 0.54% and 0.99% respectively. The Fed took it to another level when it restarted its quantitative easing program (QE), engaged across bond markets to ensure liquidity is flowing, and acted as the lender of last resort by providing loans to households and small businesses. Fiscal policy makers were also swift to respond, with Congress passing an unprecedented $2 trillion stimulus package on March 27th to support individuals and businesses until the storm has passed. Discussions continue about additional steps to take to support the market and economy.

We entered the first quarter of 2020 with a defensive/quality and US centric overweight in our Equities positions that helped mitigate the downside impact of our portfolios. The prospects of businesses both large and small being forced to the edge by the pandemic, created a genuine fear that some businesses might go under and created a shift towards businesses that were well capitalized with high cash balances. Our US centric all equity portfolios- Tactical Growth Solution and Spectrum that emphasize on strong balance sheet companies captured 65% and 80% of the market downside respectively during this period of heightened volatility. CAPSTONE, our world all cap portfolio also ended in a better position than its mid cap and small cap counterparts. We continue to remain focused on meeting our clients’ longer-term financial goals and objectives, while managing and balancing nearer-term risks. This perspective has informed our decision-making process in previous market cycles and will continue to inform our decisions going forward.

Looking Ahead

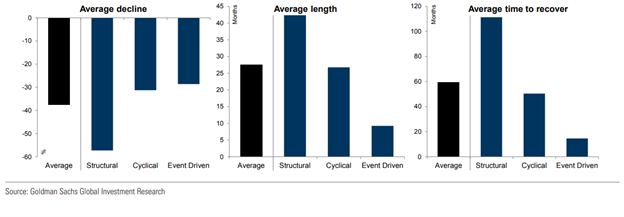

Bear markets are a part of the investing journey and some may argue that they are inevitable. However, the effect and feeling of a bear market is very real and emotionally challenging. This current bear market has exacerbated that effect when investors experienced months’ worth of market movement in a matter of days. Nonetheless, it is important for us to evaluate the current bear market from an objective perspective, that prevents us from making emotionally irrational decisions which could derail our financial progress. A study from Goldman Sachs analyzed bear markets going back to 1835 and summarized that not all bear markets are created equal and classified them into three categories- structural, cyclical, and event driven. The average decline during a structural bear market is -59%, cyclical -31%, and event driven -28%. Additionally, the length of the various bear markets is longer for structural bear markets than they are for event driven or cyclical bear markets. This makes sense as structural bear markets usually involves systemic wide issues that take time to resolve in the system.

With current bear market being event driven by the novel coronavirus, Goldman’s study shines some optimistic light on expectations going forward. However, every bear market is unique, and we’ve never had a bear market driven by a virus pandemic before. Things would most likely get worse before they get better as we write this, and an event driven bear market could possibly turn into a more structural issue. Nonetheless, markets are very forward-looking and seems to be pricing in a shorter recession but risks certainly remain. If history is of any indicator, markets generally require some light at the end of the tunnel (in this case medical progress or re-opening of the economy plans) for it to recover, and recover quickly.