After a promising start to the quarter in July, persistently high inflation, global growth concerns, and energy price shocks urged the Federal Reserve to aggressively raise rates by more than investors expected. Tighter financial conditions impacted consumer and business confidence as stock markets retested its June lows to end the third quarter, re-entering bear market territory. The Fed narrative was strong in the quarter. We will be discussing why monetary policy is so important in today’s environment and its impact on the economy and markets. We will also share our perspectives on Q2 corporate earnings, earnings estimates, and market valuations. Finally, we will shed some light on the currency markets, and the impact the dollar has on potential investment allocations.

Why is Monetary Policy Important to the Economy and Markets?

Monetary Policy is a significant driving force in the economy and financial markets today. We believe that understanding credit cycles and how monetary policy affects them at the most basic level is the first step to understanding what’s driving asset price levels and the economy.

Firstly, we believe that the dual mandate of monetary policy (full employment and stable prices) set forth by the Federal Reserve is primarily driven by the credit cycle, and that monetary policy is the tool that affects the credit cycle. Therefore, understanding how monetary policy tools affects the credit cycle could provide us with a better understanding on its impact on the economy and markets.

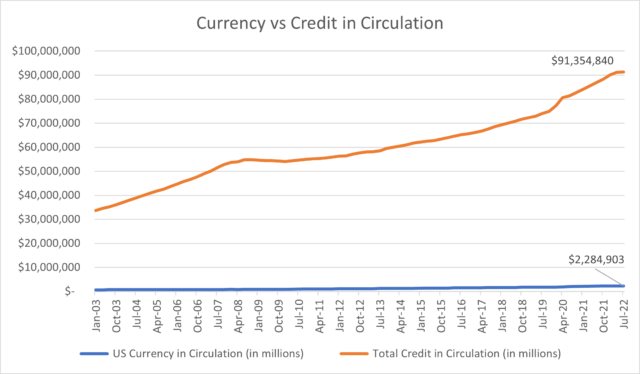

So, what is credit and the credit cycle? In simple terms, credit is the use of debt. And the creation of credit is simpler and faster than the creation of cash, which allows for more economic transactions to occur and keeps the economic engine running. The creation of credit typically requires two parties to come to an agreement to establish credit. Think about any time you open a bar tab. You and the bar owner are essentially creating credit. The bar keeps the drinks flowing while you promise to close out your tab and settle the transaction at the end of the night. That is how credit is created and dissolved. The use of credit ebbs and flows just like a cycle. During good times or when credit is cheap, people may use more credit, and credit expands. During weaker economic times or when credit is expensive, the use of credit contracts. The actual interaction with credit is often more complicated, but the example serves as a general depiction. So, why is understanding credit and the credit cycle so important? The following graph depicts the amount of credit we have in the US financial system relative to US currency in circulation.

The amount of credit is almost 50 times larger than the amount of cash currency in circulation. In other words, if the US economy was simply a cash-based economy, the economy would be much smaller, innovation endeavors would be much more restrictive, and the overall standard of living would be worse off. The size and use of credit is of paramount importance because it directly affects the pulse of the economy. A balancing act is required to establish an optimal use of credit, because too much credit could plague the economy with debt it cannot repay but too little and the economy would fail to operate at its full potential. And central banks are at the core in trying to balance this.

Today, global central banks are tightening credit conditions by increasing interest rates (thus making credit more expensive and disincentivizing the use of it) and secondly, removing liquidity from the financial system through its quantitative tightening programs. In theory this should reduce credit availability in the system. This combination of less credit available and more expensive credit is meant to slow the economy by disincentivizing the use of credit and reducing purchasing activity. In economics, one person’s spending is another person’s income. Therefore, lower spending could lead to lower income levels, which then lead to lower spending and the cycle repeats. This is how the Federal Reserve is looking to slow the economy (demand), combat inflation, weed out excess in the financial system, and buy time for supply to recover.

What stage are we in the tightening cycle?

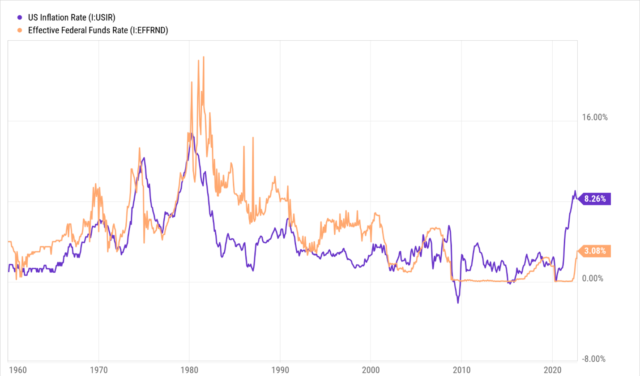

It is in our view that short term rates are nowhere near restrictive yet, but long-term rates are starting to show a restrictive credit environment. For starters, inflation rates today are more than twice the rate of short-term interest rates. This contrasts with the past, where interest rates have historically been above the rate of inflation. It was only in the past decade where rates were held at near zero, below inflation levels, and looked to be an anomaly.

Despite the aggressive stance that the Federal Reserve appear to take on inflation, their actions suggest otherwise. If the Fed is serious about combating inflation today, they would have to raise rates much quicker or by a larger amount to close the interest rate-inflation gap. However, this could lead to a harder landing for the economy and result in a more severe recession. The severity of the recession depends on the foundation of the economy and the psychology of market participants. We do not believe that the Fed wants to be blamed for a recession but the avoidance of it could result in a worse outcome. The erosion of real output due to the negative effects of persistently high inflation could lead to lower standards of living over time.

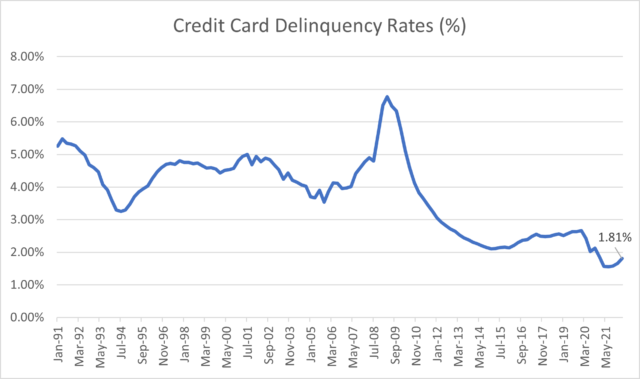

Short Term Rates & Credit Demand

Credit card debt is mostly associated with the short term effective fed funds rate (also known in the industry as the prime rate), and thus far shows no sign of being restrictive. Credit card delinquencies are still at an all-time low while balances are climbing back to pre-Covid levels- indicating a higher usage of credit card debt. A higher usage and low delinquency rates are the opposite of disincentivizing the use of credit, thus we expect short term rates to continue marching higher, and for the credit card environment to face further deterioration. We do not believe that we are at the end of the tightening cycle of short terms rates quite yet.

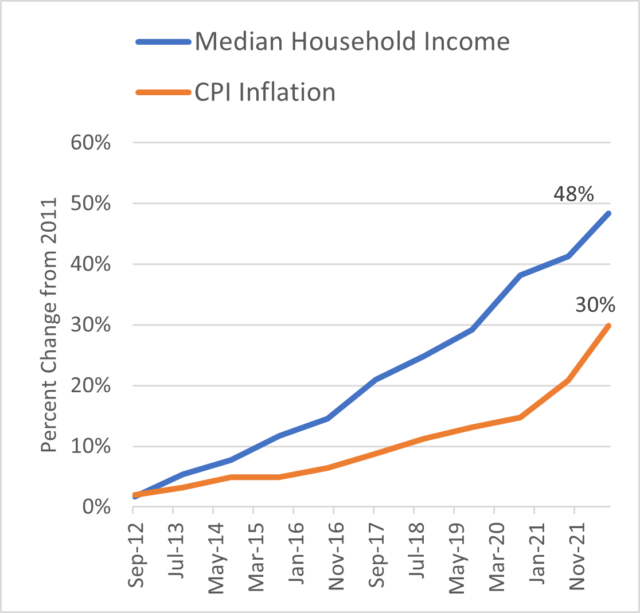

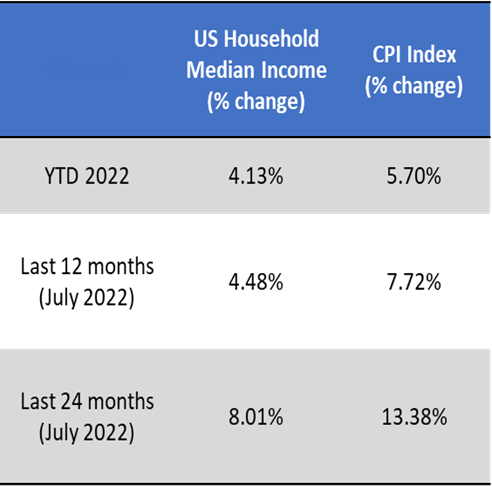

One positive about the current environment though is that the foundation of consumers (two-thirds of our GDP) continues to be strong. Median household income has risen above the rate of inflation over the past decade, although that gap has recently narrowed due to the strong inflation figures in recent years. Additionally, consumer debt service to income ratios have also dropped from over 90% to approximately 70% this year, indicating a less indebted average consumer. A stronger average consumer could hopefully offset some of the negative effects from tighter financial conditions and help consumers navigate potential dark economic clouds ahead.

Source: National Association of Realtors, Federal Reserve, Liberty One (July 2022)

Long-term rates are starting to be restrictive

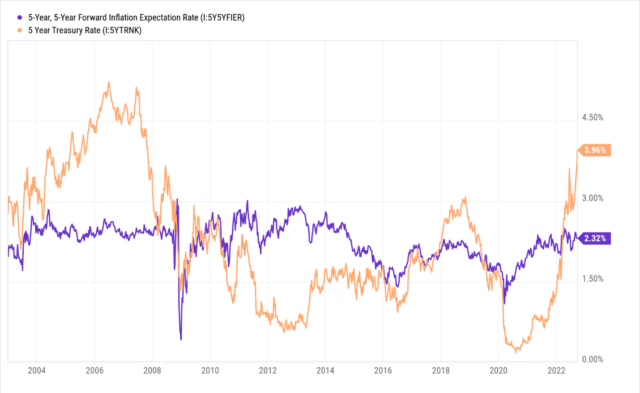

With inflation being at the forefront of policymakers’ targets, markets are expecting the Fed to successfully bring longer term inflation down towards its 2% target range. By exerting greater pain in the short term, the goal is to hopefully anchor the market’s inflation expectations at 2% to prevent any sort of price spiral. With the market’s 5-year forward looking inflation expectations at 2.32% and 5 year Treasury yields at 3.96% today, real yields are finally positive again, a feat only achieved once since the Great Financial Crisis, and that was during the last tightening cycle in 2018. That tightening cycle led to a large pullback in business investments, which proved to be premature, as the Fed promptly led to more easing no less than a year later. However, conditions today are much different than they were back in 2018.

The rapid rise in long term rates is leading to more cutbacks (if not greater scrutiny) to longer term business investments. We are seeing evidence of this in the housing market, extended sales cycle for many technology companies (primarily in software), declining auto sales, and more. All these examples are what we would classify as longer-term investments/ greater credit sensitivity industries which are more closely tied with longer-term rates and the cost of credit. A deceleration within these industries could lead to a deceleration in other less credit-sensitive industries, although the impact can vary drastically. We believe there are sectors/industries/companies that benefit under slower economic conditions, allowing for active managers to find potential value-add opportunities.

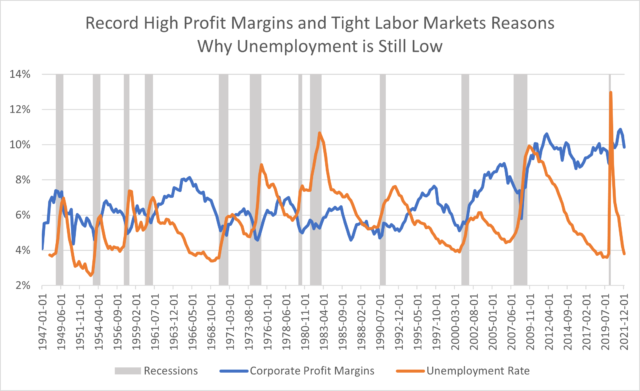

Despite signals of further deceleration in corporate America, the labor market continues to exhibit tremendous resiliency, which complicates the path of monetary policy further because the Fed had explicitly said it wants to see a softening in the labor market before considering any sort of pivot to its existing policy expectations. This is particularly true given that every recession since World War II was preceded by rising unemployment rates, which is not happening today. This piqued our interest as to what could be causing the labor market to be so strong despite signs of weakening economic activity and low consumer confidence.

One potential conclusion we could make was that corporations today are sitting on record high profit margins and finding workers is difficult these days with greater job postings than unemployed people. Corporations have a bigger buffer to absorb margin losses to retain workers in a tight labor market. However, the threshold is slowly wearing out, with a handful of corporations announcing initial firing freezes and layoffs. As you would have guessed, the bulk of the firing freezes/layoffs are coming from mortgage, housing, and technology companies- industries that are being impacted the most by tighter financial conditions.

Investors expecting a soft landing in the economy should watch this development closely because companies may be willing to retain their employees while they wait out any potential economic storm, especially if the economic storm is not as severe as expected. However, recent cracks in confidence and the threshold suggest corporations are beginning to take pre-emptive measures through their hiring decisions.

Market Sentiment vs Earnings

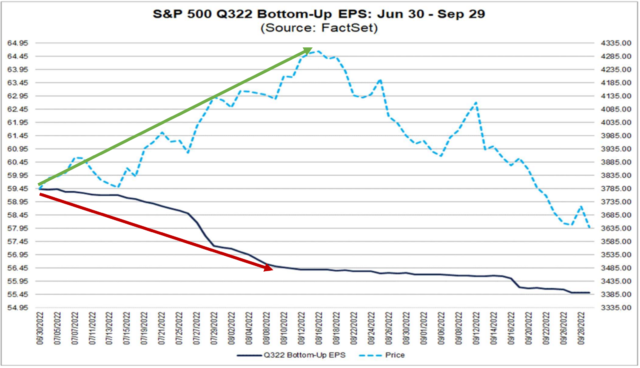

Signals of inflation potentially peaking in June were welcome news for investors. Major commodities saw prices decline from peaks in the month prior and investors were hoping that the tightening cycle may therefore also be peaking. Markets rebounded in July as a result, surging by more than 9%. The surge was led by the most beaten-down stocks, which also happen to have the most sensitivity to investor sentiment.

However, that optimism did not last long as August’s CPI (inflation) report came in larger than expected, driven by continued upward cost pressures in services (primarily wages and shelter). The Fed reiterated its aggressive stance and sentiment turned bearish once again as markets sold off.

While this was happening, bottom-up corporate earnings were indicating continued deterioration with corporations announcing earnings deceleration and lower estimates revisions. Fundamentals were portraying a different picture than what the market was pricing in.

What this past quarter’s development highlights is that markets can be extremely reactive to the prevailing investor sentiment. However, it also shows that investor sentiment is extremely volatile, and the broader market fundamentals are equally important for investors to consider.

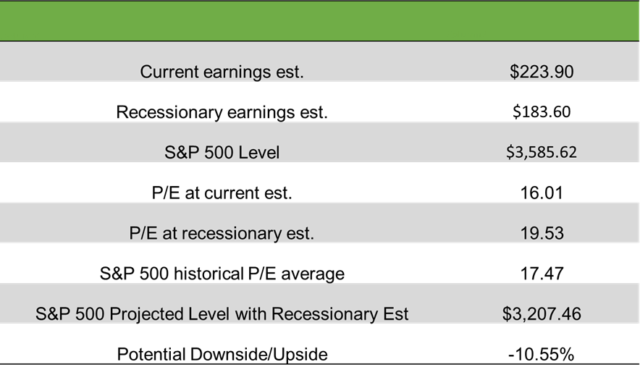

When considering market fundamentals, primarily earnings growth estimates for 2022 and 2023, consensus is pricing in earnings growth of 7.4% in 2022 and 7.9% in 2023 according to FactSet bottom-up data. Market bulls would point to this as support for a market recovery while bears would argue that consensus may be underestimating the impact of an economic slowdown on corporate earnings. We believe that earnings estimates are likely going to be revised lower should credit conditions continue to tighten and the Fed puts the brakes on the economy. Because markets are often forward-looking, we were curious as to how much negative news were already currently being priced into the markets. We projected a forward-looking bear scenario where earnings decline instead of increase, and the decline is based on the average historical earnings decline during the past six recessions in the US.

The average earnings decline in the last six recessions was -18.50%. Assuming this bear scenario, forward looking market EPS would go from currently $223.90 per share to $183.60 per share. And for simplicity purposes, we applied the average S&P 500 historical P/E ratio of 17.47x to estimate the fair value level for the S&P 500. The results highlight that the S&P 500 would be fairly valued at the $3,207 level under a recessionary scenario, which is a potential -10.55% downside from current levels.

The summary from this quick exercise highlights that markets have probably priced in a fair amount of negative news already, although further downside could be in store (albeit fairly mild).

Dollar strength and implications of investment positioning

Global growth weakness, more attractive rates in the US, and investors’ appetite for safe-haven assets are driving the dollar to its strongest level since the early 2000’s. A strong dollar has two main implications that we believe investors should be aware of. First, a strong dollar exacerbates inflationary pressures for economies outside the US, but is helping offset inflationary pressures domestically. Although a benefit to the US economy, investors should be mindful of any contagion risks that could spread from abroad due to the consequence of a currency crisis. We view the Asian Financial Crisis in the late 90’s as a lesson from the past that we can learn from. Secondly, a strong dollar is also likely to hurt corporate earnings further, solidifying our base case for further downward earnings revisions. Technology companies have an outsized influence on the S&P 500, and the technology sector also has the largest percentage of revenues generated abroad relative to other sectors, creating a headwind to the bottom line.

From an investment allocation perspective, we’ve experienced a strong dollar for most of the past decade, really since the Great Financial Crisis. During this period, the dollar index increased by 49%, US stocks (S&P 500 as the proxy) increased by 181%, and International stocks (MSCI World Ex-USA as a proxy) declined -14.11%. Needless to say, returns in international stocks were underwhelming, causing many to abandon that asset class as portfolios became more US centric.

However, as long-term investors, it is critical to understand that the prevailing economic environment is not expected to last forever, and we could see a change in economic regimes over the coming decades. When the dollar index declined by -38% from 2002 to 2008, International stocks outperformed US stocks, returning 82% for international stocks vs 19% for US stocks during that time period. The dollar index has historically been a strong indicator of future returns for international stocks and warrants close monitoring.

Final Thoughts

Credit is widely used in our financial system but often its impact on the financial markets and economy is underestimated. Credit keeps the economic engine running and monetary policy is at the forefront in trying to balance the amount of credit in our system. Today, credit is becoming more expensive as the Fed continues to raise rates, disincentivizing the use of it to slow demand in the economy. We believe that the current tightening environment affects sectors that rely on credit purchases the most, primarily in housing and business investments. Earnings expectations in our view also appear to be optimistic and expect to see continued lower revisions as we move towards the end of 2022 and into 2023. However, markets have appeared to price in a fair amount of negative news already, although further declines in the major indices is still a strong possibility.

Nonetheless, with investor sentiment currently at extremely bearish levels, markets could experience a short-term rally as a change in market bottom expectations could fuel some risk taking among investors. However, headwinds are plentiful today, with the Fed putting downward pressure on asset prices, it is unlikely that we will see a major market rally until the Fed pivots or until there is a strong expectation that the Fed will pivot. Finally, we believe that developments in the currency markets requires close monitoring and could potentially provide attractive return opportunities in the future.

As for portfolio positioning, we believe strong cash flow and reduced volatility are of greater significance today. There are a variety of ways one can accomplish this and believe that active managers are positioned well to outperform in today’s environment. Liberty One has several flagship allocations designed to solve these challenges and we invite you to reach out to our team to learn more about our solutions.