Weak performances across most asset classes in 2022 were a wake-up call for many investors that were conditioned in a low interest rate environment over the last decade. As the Fed embarked on one of its fastest tightening cycle in history, the very structure of the investment landscape was flipped upside down- and what did the best in a liquid, cheap money, risk-seeking environment (speculative tech, cryptocurrency, venture capital, etc.) now did the worst. Rising interest rates and rich starting valuations drove many of these asset prices downwards, while restrictive monetary policies and high inflation tightened consumers’ purchasing power that led to slowing economic growth. For much of 2022, inflation and interest rates were a key focus- both in financial markets and mainstream media. However, as we move into 2023, we believe that financial markets are starting to move away from inflationary fears, and towards recessionary fears, which could impact investor focus and portfolio positioning in the coming year.

Markets are Finally Normal Again

For much of the past decade, we believe that central bank interventions led to a dysfunctional market pricing system because asset prices were supported not by free markets, but by global central banks whose motivation was liquidity and a stable financial system. This perpetuated increased investor risk appetites (backed by the so-called Fed’s put) which increased the probabilities of mispricing and asset bubble formations. The post-Covid market recovery was an example of such mispricing when speculative asset classes soared in prices (speculative tech, cryptocurrency, venture capital, etc.). However, it didn’t take long for such bubbles to pop when the Fed removed (the punch bowl) by raising rates at an incredible pace in 2022. As such, the bubble burst just as quickly as it had formed- which leads us to where to are today.

The threat of new bubble formations and bursts have been substantially mitigated as one could argue that pockets of asset bubbles popped in 2022 while the threat of new asset bubbles forming is low due to an absence of FOMO behaviors today. Additionally, without the central bank’s perpetual support for financial markets, we believe that the invisible hand of free markets is back at work to drive efficient price discoveries. Diverse investor perspectives and opinions are key ingredients to that efficient pricing system which we believe has become more prevalent. As market outlooks among investors become more divergent, threats of asset bubbles mostly diminished, and financial support by the Fed fading, we believe that these are conditions of a normal market environment that are very encouraging for a high functioning capital market system.

The Inflation Story

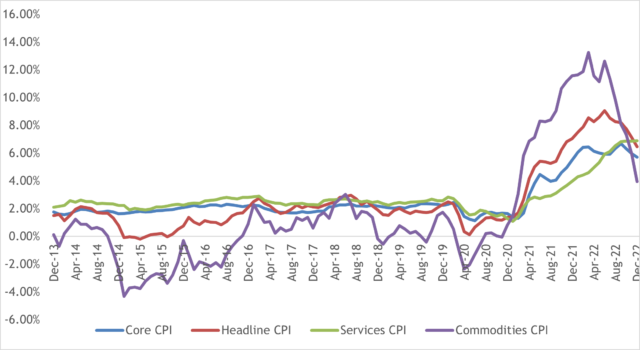

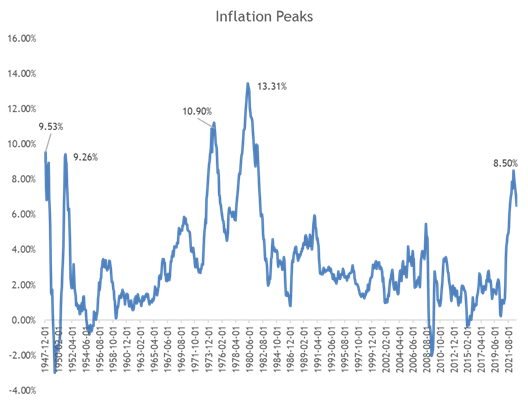

Although current inflation numbers are still uncomfortably above the Fed’s key 2% inflation target rate, inflation numbers are showing a continued downward trend.

Inflation appears to have peaked in Summer of 2022 with core CPI declining -14% from its peak and headline CPI declining -28% from its peak. This was primarily driven by a decline in the commodities prices- with the commodities CPI declining -70% from its peak. We believe that a further decline in commodities prices would lead to more downward pressure on both the core and headline CPI figures. Despite these developments, the Fed appears to be persistent on its rate hike cycle due to the stickiness of services inflation. In fact, services CPI is currently at its high, which could put upward pressure on inflation. Rent inflation strength and a tight labor market are forces within the services CPI that are keeping the numbers stubbornly high.

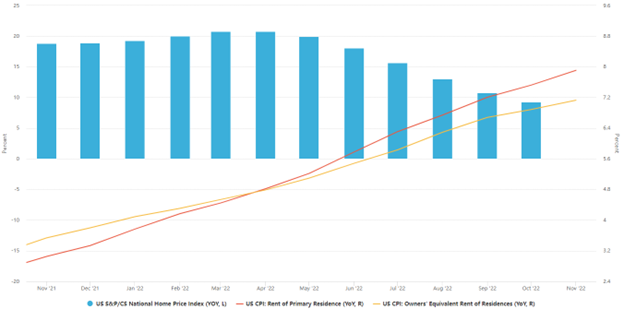

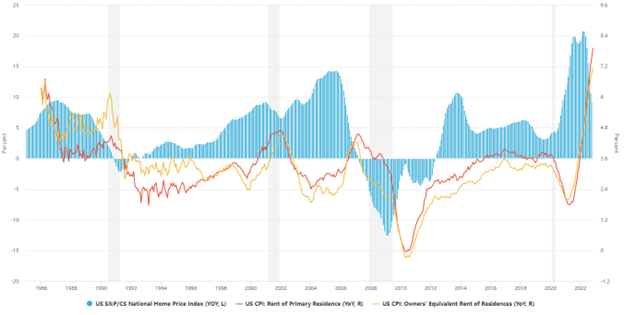

Rent inflation continues to be sticky despite a deceleration in home prices. However, we believe this is a result of a price adjustment lag between rent inflation and home prices. Historically, home prices and rent inflation move in tandem, although with an approximate 18-month lag. This time is no different. The lag is a result of lease arrangements. This is because lease terms are typically fixed by nature and only reflect updated price dynamics once the lease expires. This dynamic is the main driver for such lag. As home prices appeared to have peaked in Spring of 2022, we’d expect rent prices to reflect broad deceleration by Fall of 2023 if not sooner. Therefore, a deceleration in rent prices would only be a matter of time, and should have a large impact on services inflation- given that shelter costs makes up close to 40% of the services CPI.

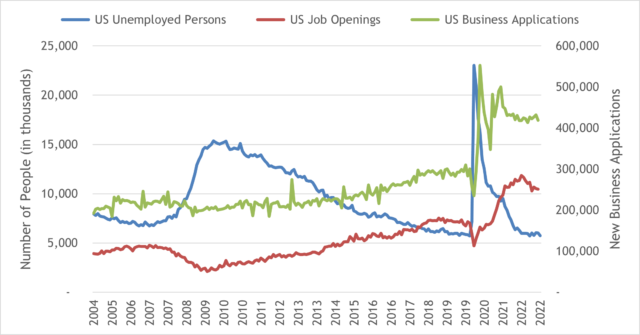

The other critical aspect of service inflation is labor. Wages are a large component of the cost structure within the services industry and continue to show resilient growth in part because of a strong labor market. The labor market continues to be extremely tight with job openings still outpacing unemployed people by a ratio close to 2:1. This relationship was mostly the opposite in the last 20 years, with unemployed people outnumbering job openings.

In trying to understand the existing labor market conditions, we looked for outliers in the data that could potentially help explain the conditions of the labor market. One piece of data that stood out to us was new business applications. New business applications surged during the Covid-pandemic as the introduction of new telecommunication applications bolstered the convenience of remote work and eliminated the perceived barriers of work. This led to an increase in quit rates, but also new business applications. This is problematic for the labor market because the labor market now must fill more than one job position. It must fill for the replacement of the employee that just quit, and the new job positions that are created because of a new business being formed. Add in a skill gap issue and we now have more job openings than we can fill. Should the economy continue to slow, we could see the tightness of the labor market ease up a little, but it is our expectation that a tight labor market could be a new normal moving forward- due to the increase in entrepreneurship that has been supported by technology in lowering the costs and barriers to start a business.

Given the deflationary direction the economy is heading, financial markets appear to be moving beyond its inflationary fears, with the breakeven rate (difference between nominal Treasury yields and TIPS yields) pricing closer to the Fed’s long-term 2% inflation target.

Recessionary Fears?

Taming the labor market without sending the economy into a recession seems to be the final task that the Fed is fighting to accomplish. The Fed has openly stated that for the labor market to cool, growth in the economy would have to run below potential for some time. This coupled with the intention to keep rates around 5% in 2023 (whether or not this happens remain to be seen), has many economists and market participants worrying about recessionary implications from such actions. In fact, a mild recession seems to be the base case consensus scenario as both the bond and stock markets would suggest. Additionally, in the Fed’s December’s Summary of Economic Projections, they expect unemployment rate in 2023 to be 0.9% higher than 2022 (4.6% vs 3.7%). Historically, an increase of more than 0.5% in the unemployment rate within a 12-month period has coincided with recessions.

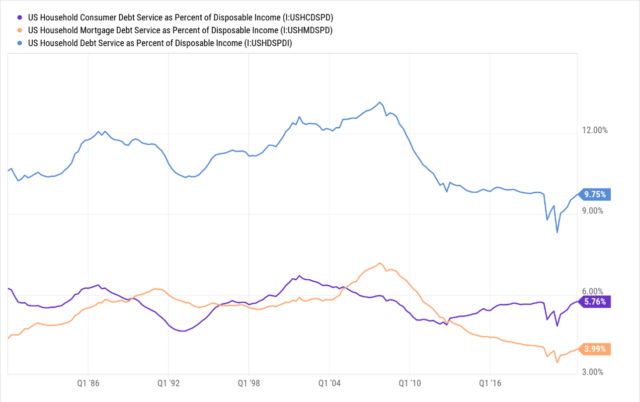

Should the economy enter a recessionary phase, we believe that households are fundamentally stronger to weather the storm given their stronger financial standing. Households entered a deleveraging phase post-2008 and have shored up their balance sheet. The consumer deleveraging cycle could also help explain why the economic recovery post 2008 was weak at best, despite strong levels of innovation supported by stimulative polices. Household debt service ratios have improved dramatically since the financial crisis. The large decline in debt service levels was primarily driven by very low mortgage debt service as a percentage of disposable income, courtesy of refinancing at very low mortgage rates over the course of the last decade. Given that housing activity has slowed substantially, mortgage debt service is unlikely to rise as much, as homeowners will be reluctant to change their mortgage terms. Consumer debt however is not as sticky as mortgage debt due to its composition: Consumer debt is mainly auto and credit card debt; the former has low duration, and the latter has adjustable rates. As more income share shifts toward debt servicing for consumer and student debt, spending could be impacted, and business results could weaken. While this might cause economic hardship in the near term, the impacts on households are likely to be cyclical in nature due to their strong balance sheets and relatively low leverage measures. Finally, households are also financially wealthier post-Covid than where they were pre-Covid as net worth levels have surged by more than 22% in less than 2 years, even after weak financial returns in 2022. This sets the consumer up very well for periods of future economic growth.

The current S&P 500 earnings consensus suggests a slight increase in earnings growth for fiscal year 2023 which would imply little to no deterioration in aggregate spending in the economy. We believe this to be an optimistic scenario as current spending trends are unsustainable, especially if the recessionary scenario were to come to fruition. Companies and analysts have yet to alter their estimates because management have mostly avoided providing 2023 financial estimates due to an increased level of uncertainty. However, as 2023 progresses, management would be more inclined to provide their estimates and a more than expected downward revision to earnings would be challenging for investors. As a result, we believe that earnings expectations and near-term earnings risk is one of the more important short-term market risks.

Investing in Peak Inflationary Periods

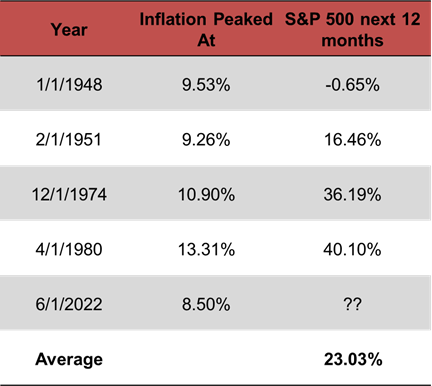

Investors have historically been rewarded well when investing in peak inflationary periods. For starters, deflation is a good thing for fixed income investors because they benefit from higher real income while also capturing capital appreciation potential from declining interest rates. 1981 was an extreme example of this. If an investor invested in a 10-year Treasury bond at peak inflationary levels that was yielding close to 15% in 1981, that investor would have enjoyed either a very attractive income stream with falling inflation or would have been able to capture a rise in its bond price if sold before maturity.

As for the stock market, investing at peak inflation has also yielded positive results. In the past four periods where inflation peaked above 9%, the average market return in the following 12 months averaged 23.03%.

The Outlook

After years of intervening in financial markets, we believe that the Fed is now taking a less active role and handing the reigns back to free markets to allocate economic resources more efficiently. As a result, we believe that stock performance dispersion is likely to be wider in the next decade relative to the last. We anticipate spreads to widen should a more severe recessionary scenario play out, but yields could fall. As a result, we currently favor higher quality fixed income to its lower quality counterparts and extending duration.

Additionally, we think that there are plenty of well-positioned companies within financial markets. Corporate balance sheets in general are strong as many have refinanced at low rates. Consumer balance sheets remain very healthy even if a recessionary scenario were to arise. Valuations have mostly fallen across the board, although one could argue that markets have become cheaper but aren’t necessarily cheap. From a relative valuation perspective, small caps and international appear to be relatively more attractive with their valuations trading below its long-term average. International investments could get a boost once tight monetary policy transitions into neutral policy. A combination of higher US fiscal deficits, strong dollar today, and a potential for faster global economic growth favor a weaker dollar which creates a boost for international investment.

Certain near-term risks for financial markets include earnings and policy risks. Should corporate earnings fall by more than expected but not enough to suggest a struggling US economy, that could be a double whammy for stock markets as stocks could struggle from downward earnings revisions without getting any help from lower interest rates. Policy risks that include excessive monetary tightening by the Fed could also result in a hard landing for both the economy and markets.

For longer-term investors, we expect the stock market to continue to grow with continued consumption, production, and innovation. The $1 trillion infrastructure bill that was passed recently could also act as a tailwind for economic growth as America starts building in the next 10 years. As for our fiscal deficits, we anticipate a deleveraging cycle within the public sector to occur as higher interest expenses and higher debt burdens make deficit financing through borrowing less attractive. At the extreme, higher taxes on top of reduced spending could also be on the horizon over the next decade in trying to remedy our public fiscal position.